Disability and Sickness Benefit Factsheet

There are a range of benefits that you may be able to receive if you have a disability or ongoing medical condition. These are Disability Living Allowance (for those Under 16), Personal Independence Payments (16-below state pension age), New Style Employment and Support Allowance (for those who have sufficient NI contributions) and Attendance Allowance (for those of pension age). If you are caring for somebody who is receiving disability benefits you may be able to claim Carer’s Allowance.

PIP is for people aged between 16 and (usually) state pension age. It is split into two elements. The Daily Living Difficulties element can be awarded if people need help more than half of the time with things like preparing or eating food, washing, bathing or using the toilet, dressing/undressing, reading and communicating, managing medication/treatment, making decisions about money and engaging with other people. The mobility difficulties element can be awarded if you need help moving about or going out.

PIP is not means-tested and you can claim it whether you are or are not working. It can be awarded for mental health conditions as well as physical disabilities/illnesses.

An overview of PIP can be seen here (https://www.gov.uk/pip)

How to claim: You will need to either phone the Claim line on 0800 917 2222, Textphone 0800 917 7777 or Relay UK 18001 then 0800 917 2222.

Click here for more information on how to claim.

You will need to have available:

-

your contact details, for example, telephone number

-

your date of birth

-

your National Insurance number - this is on letters about tax, pensions and benefits

-

your bank or building society account number and sort code

-

your doctor or health worker’s name, address and telephone number

-

dates and addresses for any time you’ve spent abroad, in a care home or hospital

You can also send in a letter requesting a form to send this information by post but this is likely to delay your claim. The address to send the letter to is:

Personal Independence Payment New Claims

Post Handling Site B,

Wolverhampton,

WV99 1AH

After providing the information above you will be sent a PIP application form which will need to be completed by the date given. Our advisors are experienced in completing these forms and helping people to think through how to answer the questions. If you would like support with a PIP form please contact us.

If you have an illness or disability which is preventing you from working, you may be able to claim the New Style ESA. It is a contributory benefit meaning that you will have to have been paid enough or credited with enough National Insurance contributions during the two full tax years before your claim. Your savings and your partner working do not affect your claim. New Style ESA can either be claimed on its own or with Universal Credit, however, anything that you are awarded will be taken out of your Universal Credit.

Those accepted for New Style ESA will be placed into two groups; A work Related Activity Group for those who will be able to work in the future and a Support Group for those who won’t be able to. The benefit lasts for 365 days for those in the Work-Related Activity Group. There is no time limit for those in the Support Group.

How to Claim: You will need a fit note from your GP but can start the claim before this has been obtained.

You can start your claim online and will need:

-

your National Insurance number

-

your bank or building society account number and sort code (you can use a friend or family member’s account if you do not have one)

-

your doctor’s name, address and telephone number

-

details of your income if you’re working

-

the date your Statutory Sick Pay (SSP) ends if you’re claiming it

To check if you are eligible for New Style ESA and to start your claim - Click here

If you need help to negotiate your way around the New Style ESA application please Contact Us.

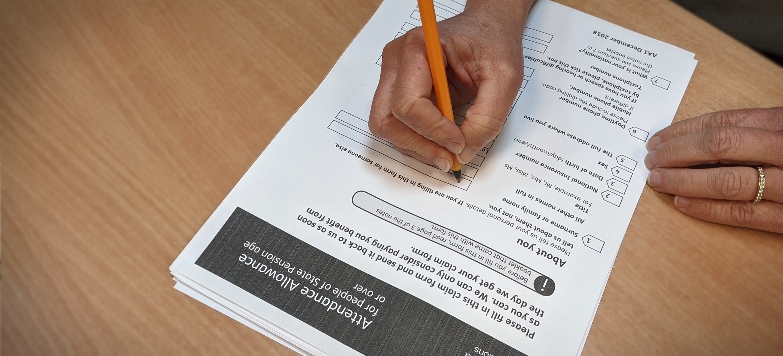

Attendance Allowance is for those who have reached the age where they can claim a state pension.

The benefit can be claimed if you have a disability or ongoing medical condition (physical or mental health) where you need somebody to help look after you. It does not cover mobility needs. You have to have needed the help for over six months unless you are terminally ill and in that situation, there is no qualifying period.

How to Apply: click here for an application form.

Alternatively, you can phone to request a form (including a larger print or braille copy) on: 0800 731 0122, Textphone 0800 731 0317 or Relay UK 18001 then 0800 731 0122.

This is a benefit you may be able to claim if you are caring for somebody else.

To claim Carer’s Allowance both you AND the person you are caring for, need to meet the eligibility criteria.

The person you are caring for must receive an approved benefit and the carer must be over 16, spends at least 35 hours a week caring for the person, not be studying for more than 21 hours a week or more and earning less than £128 a week after tax, National Insurance and expenses. Click here for the full list of criteria

How to claim: To claim you will need to have your NI number, bank details, P45 if you have recently finished work, course details if you are studying and details of any expenses, such as the cost of care for your child or the disabled person whilst you are at work. You also need the date of birth, address, NI number (if over 16) or DLA Allowance reference (if under 16) of the person you are caring for.

Click here to apply